The good news is that you no longer need to use pen and paper to calculate your HRA exemption amount. 40% of the basic salary if the taxpayer is living in a non-metro city.50% of the basic salary if the taxpayer is living in a metro city.

Actual rent paid less than 10 % of the basic monthly salary.Also, your tax exemption under HRA is taken as the lowest of the following amounts: If you have your own accommodation or live with your parents, then HRA is fully taxable. You can easily fill out and download the rent receipt from the ET Money website and submit it after affixing the revenue stamp and getting it signed by your landlord or landlady to claim the HRA benefit. Leave Travel Allowance.įor HRA, remember you can claim HRA only if you live in a rented house and can submit valid rent receipts as proof. The major exemptions you get are HRA i.e. Next, take out the exemptions provided on the salary components.

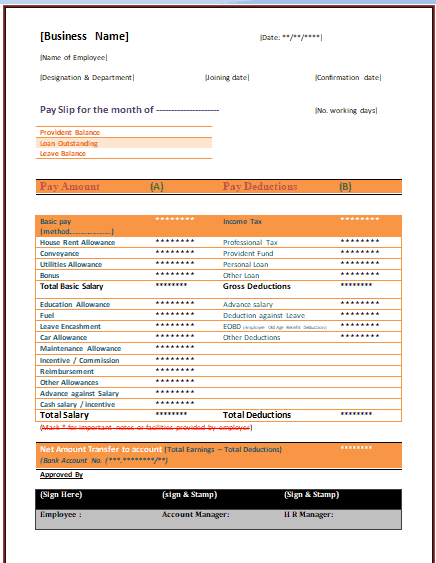

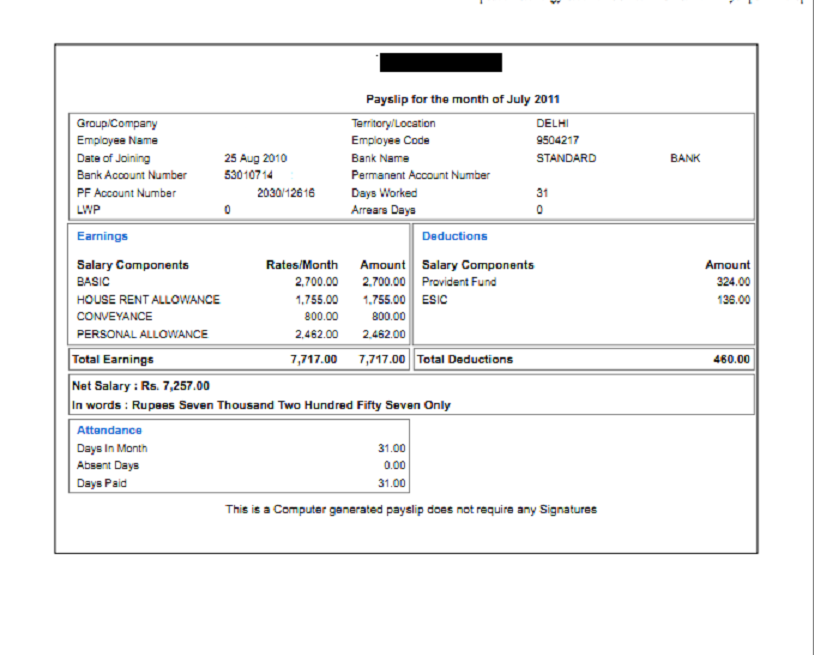

This will include all the components of your salary, including House Rent Allowance (HRA), Leave Travel Allowance (LTA), and special allowances, like food coupons and mobile reimbursements. To make it simple, here are the 5 steps that you can use to calculate income tax on salary: Step 1: Calculate your gross incomeįirst, write down the annual gross salary you get. Though it seems simple, it consists of several steps, including calculating gross salary, calculating deductions and exemptions, calculating tax payable, deducting tax already paid, etc. Generally, tax is calculated by multiplying the applicable tax rate with the taxable income. Calculating taxable income is laced with complicated calculations and adjustments, so we take you through them to simplify the math. It is an essential variable on which income tax on salary is determined. Now, taxable income is an individual’s income minus the tax exemptions, deductions, and rebates.

The tax slabs are decided based on one’s income and age. This term individual applies to a person, Hindu Undivided Family (HUF), company, cooperative societies, and trusts. The government levies income tax on an individual’s income. First, what is income tax? And, what is taxable income? In this blog, we show you how to calculate income tax on salary with examples, so that the next time, you can do your own math and take enough measures to save as much tax as possible. With ever-changing tax laws and several jargons – tax exemption, tax rebate, tax deduction, tax saving, etc – to decipher, most of the time we do not even realize what portion of our income is being taxed, and how we can save some money. By many, income tax is looked at as a necessary evil.

0 kommentar(er)

0 kommentar(er)